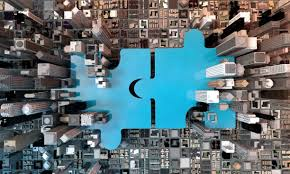

When one business contemplates acquiring another business, it can do so in the form of acquiring shares or purchasing the assets.

Usually the Acquirer (Buyer) will want to structure the deal as an asset purchase. This is primarily due to successor liability concerns (See California Corporate Code 1107 and Ray v. Alad Corp. (1977), 19 Cal.3d 22). Another important factor will be the Buyer’s desire to obtain a “step up” in basis of the appreciated asset, reflecting the actual purchase price.

From the Seller’s perspective, if a complete transition and clear break is the objective, a stock purchase is the desired acquisition structure. Essentially the buyer will “step into the shoes” of the seller, and take on all benefits, obligations, and liabilities “as is” (unless contractually taken into account or structured otherwise). Further, the seller often wants to benefit from the preferential long term capital gains treatment available with a share purchase.

There are many other considerations and exceptions to the above two general dispositions. For more information please contact the Law Offices of Hanlen J. Chang

Disclaimer